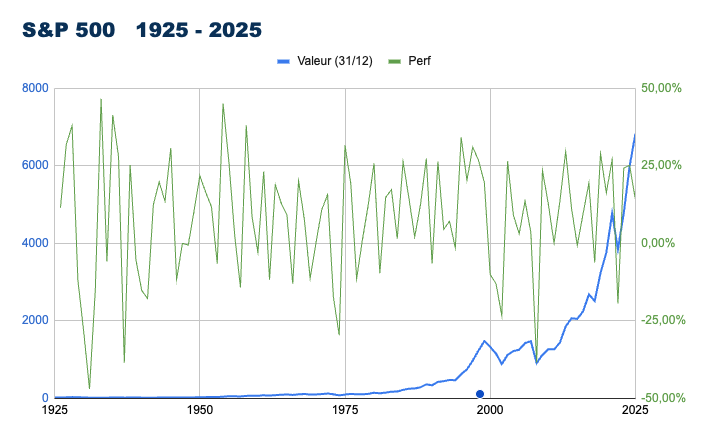

A 50% market decline is not a risk; it is the entry fee for the sophisticated long-term investor.

Volatility is the fundamental essence of financial markets. Mastering one’s emotions during bearish cycles determines long-term investment success and growth. 📈

Capital Discipline

Equity investing demands absolute psychological resilience. Without a stoic acceptance of major corrections, investors inevitably face mediocre results, falling short of the excellence standards required by global financial markets and the most prestigious institutions. 🏛️

The Cycle Test

A 50% drop in valuations historically occurs several times per century. For shareholders, these episodes are not anomalies but natural selection tests separating emotional speculators from true wealth builders who understand the value of time. 📉

The Patience Premium

Superior returns are the direct reward for equanimity. By refusing to succumb to collective panic, asset holders preserve their capital and maximize their chances of capturing the structural growth of the real economy and global industries. 💎

Stock market success depends less on pure intelligence than on the ability to remain calm during systemic market turmoil.